June 2 – 28

As we wrap up this trip, we’ll examine how it differed from some in the past in that although we were cost conscious, we weren’t obsessive about it and has been a more recent pattern for us, did not include any camping. This naturally makes the total expense higher as indoor lodging is always costlier and without being able to prepare meals in camp, food costs can run quite a bit more as well. We were also fortunate to travel under a strong dollar, trading at just above even at a consistent 1.08 dollars to the Euro. Essentially, each Euro spent costs us an additional eight cents. Compare this to our 2014 trip when we were trading at 1.30 dollars to a Euro, and one sees the impact exchange rates can have on the overall expense of a trip.

But realistically, most folks are going to be traveling for just 1-3 weeks and so the exchange rate is not necessarily a serious consideration. For our month, we spent 5,746 Euros which converted to $6,409. A higher exchange rate of 1.17 (our 2017 trip) or 1.30 (our 2014 trip) would have made this trip cost us $6,722 or $7,470, a difference of $313 or $1,060 respectively. So, at its highest point, a strong Euro that adds a significant sum to the cost of a trip may very well discourage someone from traveling at that time. Otherwise, in most cases one needn’t worry about the exchange rate dramatically altering the good time you will have.

2023 Trip Costs

| Type of Expense | Trip Total | Average Per Day |

| Lodging | $2,431 | $87 |

| Food | 2,122 | 76 |

| Culture | 204 | 7 |

| Misc. | 374 | 13 |

| Public Transportation and Parking | 1,278 | 46 |

| Total | $6,409 | $229 |

Our largest expense categories were lodging and food at $2,431 and $2,122, respectively. This is to be expected, but when you examine lodging, our average daily rate of $87 is exceedingly affordable, which is common for travel in Europe. As I’ve mentioned in previous posts, we’d be hard pressed to ever consider staying at hotel or motel for less than $50 here in the states. In Europe, that amount will usually provide you with basic and clean options, sometimes even with a bathroom ensuite.

Another consideration when it comes to traveling in Europe is how to handle your money. Until the creation of the European Union and as a result the launch of the Euro in 1999 when for the first three years it was an ‘invisible’ currency, only used for accounting purposes and electronic payments. Coins and banknotes were launched in January 2002, and in the 12 EU countries impacted, it was the biggest cash changeover in history.

So, before the Euro one had to use the specific currency of each country visited, which while a romantic concept, was frankly an annoyance as it meant one had to convert dollars to that currency as well as any leftover cash from the last country visited. Prior to the advent of widespread ATM’s and use of credit cards, this meant either carrying your dollars completely in cash or using a now arcane tool known as the Travelers Check. This then meant needing to cash one or more of the checks and each transaction garnered a fee, usually a percentage of the dollar amount. The best option for cashing these checks was almost always found at a legitimate bank to minimize loss on the exchange rate and that percentage fee, but this meant having to do so on a weekday when the banks were open.

Obviously, one had to carefully project how much money they were going to spend in each country to reduce the amount of leftover currency that would need to be converted when arriving in the next country, thus compounding the expense of exchanging because you were now incurring a fee multiple time. The worst scenario crops up when you are leaving a country at the end of the week and are running short of local money. How much do you exchange to get through the next couple of days? Invariably you’d guess wrong and get stung with a later exchange.

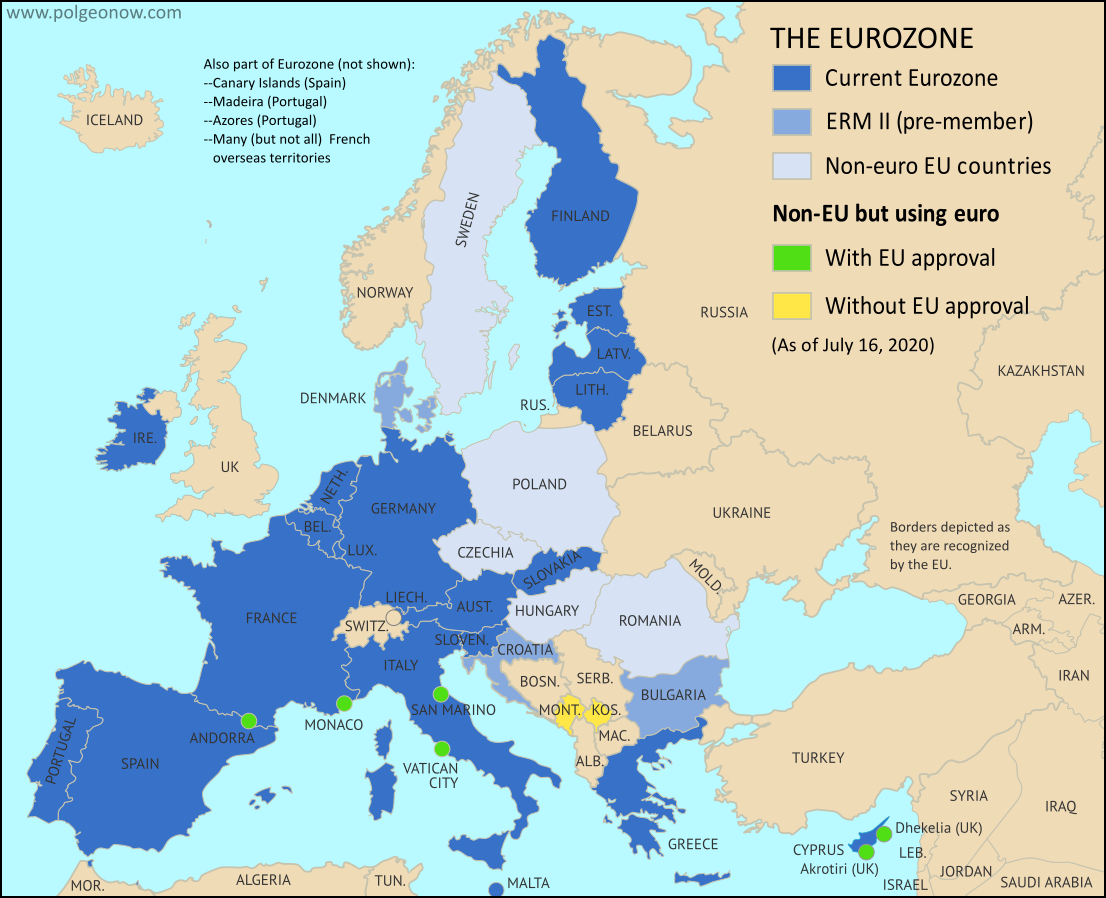

Today the money issue is much simpler. There is one unified currency for the twenty countries in the Euro Zone (Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain) so here one has to exchange for Euros. There are seven non-eurozone members of the EU; they are Bulgaria, Czech Republic, Denmark, Hungary, Poland, Romania, and Sweden. They continue to use their own national currencies, although all but Denmark are obliged to join once they meet the euro convergence criteria.

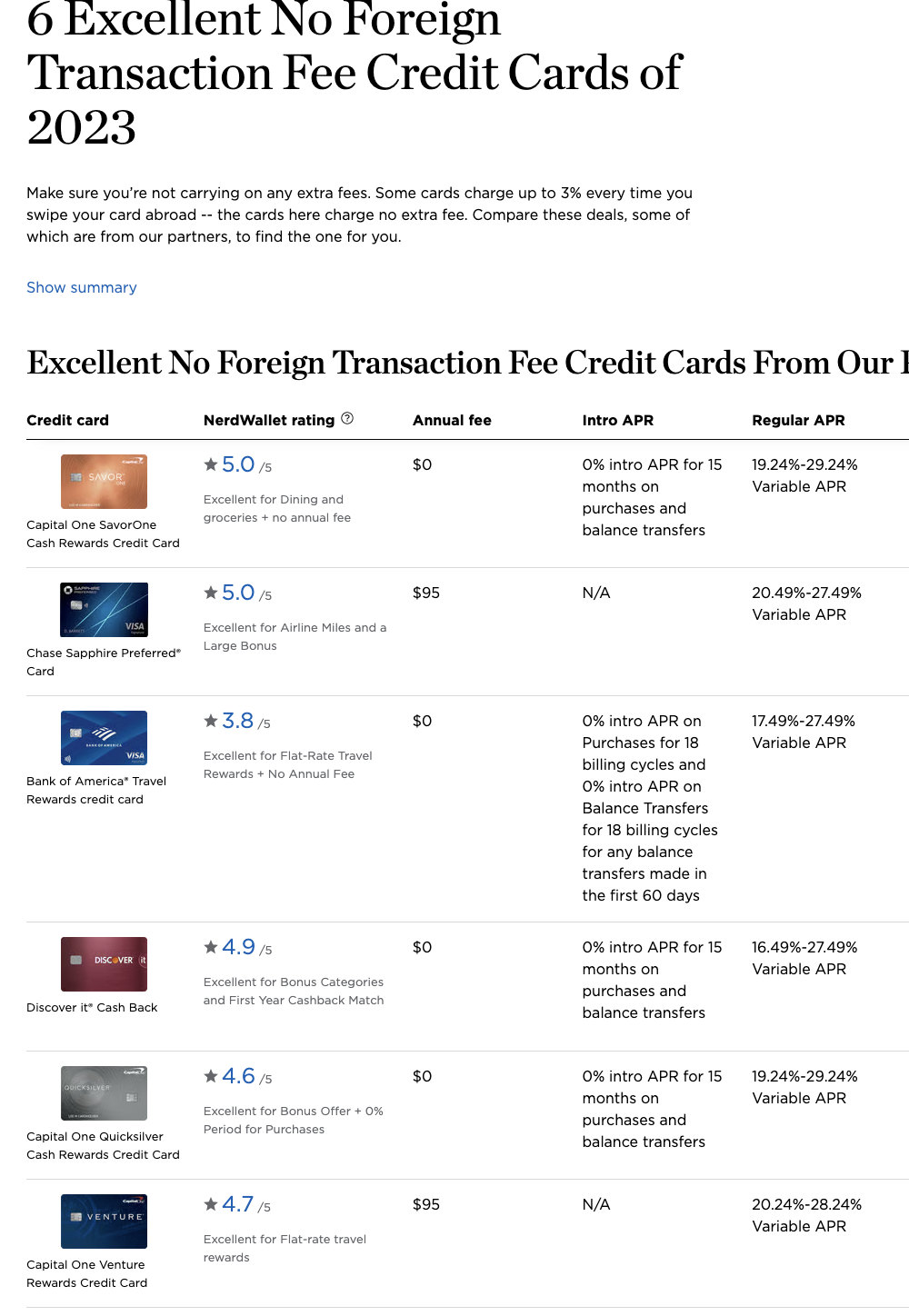

Credit card use is now ubiquitous as well reducing the need to carry loads of cash. An added bonus for using a credit card, but only if one of the features of the card is the absence of a foreign transaction fee, is the amount charged to the card is not burdened by any fee, which can range up to 5% of the amount charged if you are using a card that charges that fee. An even bigger bonus with credit card use is you get the bank rate which is always better than the one you would get at an exchange counter at the airport or a tourist office.

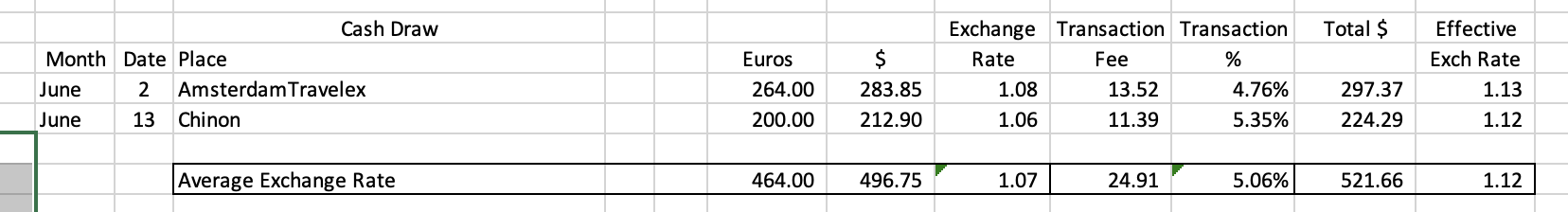

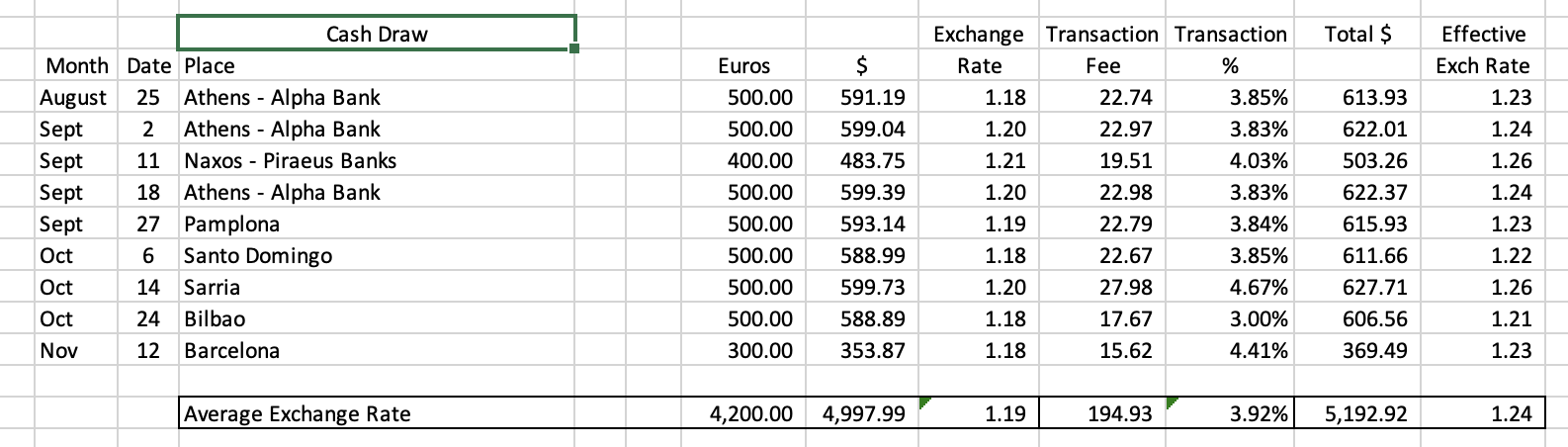

Using an ATM to draw cash is the way to go as you again get the bank rate, but you are penalized by a fee charged on top. This is usually a flat fee (often $5) for using an out of network ATM plus a percentage fee on the amount withdrawn. This means, at the end of the day, if the dollar is trading say at 1.08, that will generally be the rate you get charged for an ATM withdrawal, but the effective rate will now be 1.13, so roughly 5 cents more per dollar. For this trip, we only pulled cash twice, the first time on arriving in Amsterdam. We usually hit an ATM after claiming our luggage, but this time we had some spare Euros left over from a previous trip and used a credit card to purchase our fare for transit from the airport to the Central Station where we pulled our first withdrawal. The second time was two weeks later in Chinon, France which brought our total cash withdrawal to 464-Euros. The exchange rate on the transactions averaged out to 1.07 and we were charged a flat fee of $5 each and combined transaction fees of $24.91 for a total of $521.66 getting us to that cash exchange rate of 1.13.

Which means that of the $6,400 dollars we spent, only 8% was with cash. This will not always be the case though. In some instances, where you travel will be rural and perhaps not as advanced as other places and you will need to use more cash than anticipated. During our 3-month trip in 2017, we spent a month in Greece and a month traversing the Camino de Santiago in Spain. For this journey we had to use cash 66% of the time, which required being cognizant of where and when we could locate an ATM.

And so, as our travel needs have changed over time, we are adjusting our budget planning to accommodate a higher cost per day as we eschew those modes of travel, in particular camping, which enabled us to keep our overall outlays lower in the past. And this will be the case for anyone traveling today, that is budget for what makes you comfortable and once you’ve done so, you can rest assured that with the advent of credit cards and ATM access, how you access and spend your money has become much, much simpler and easier.

Links

FlixBus: https://www.flixbus.com/

Discover more from 3jmann

Subscribe to get the latest posts sent to your email.

I enjoyed your insight and pictures. Nothing beats real world experience!